I never thought I'd turn a $18,400 funeral bill into a family Legacy, but "The Legacy Shield" made it possible!

It wasn't always easy though...

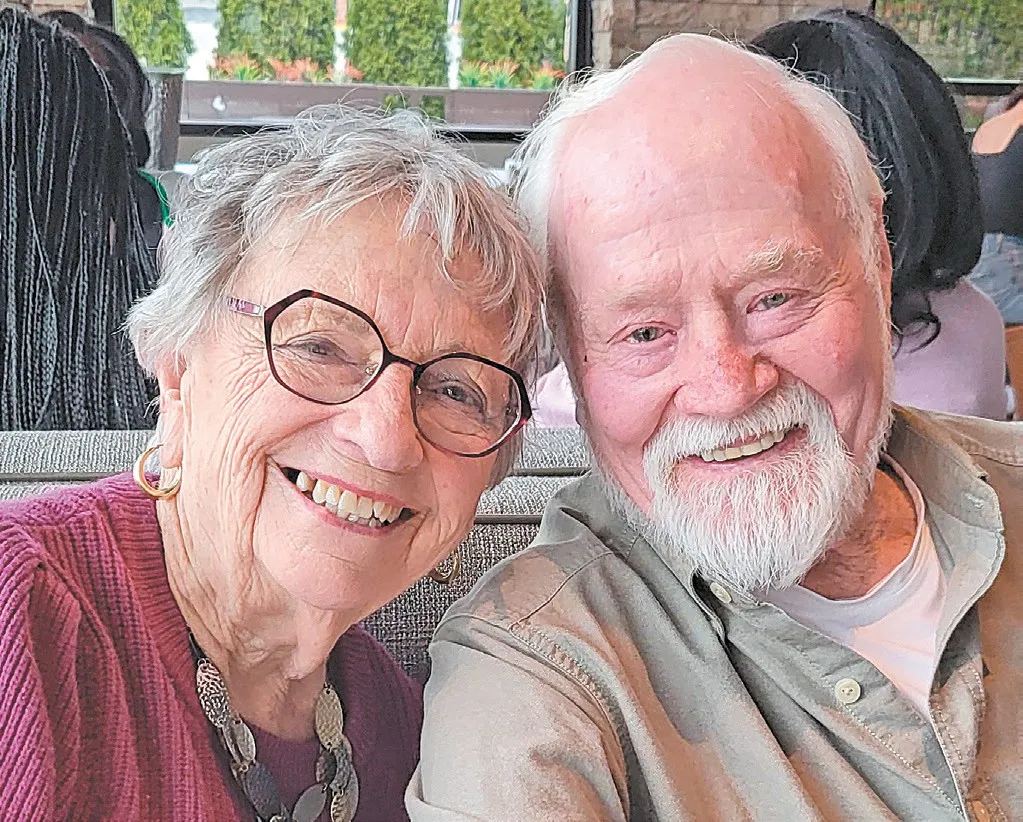

Me and Sarah loved each other for 48 years

The funeral director's words hit like a punch to the gut:

"Mr. Johnson, the total comes to $18,400. How would you like to handle payment?"

"Harold, promise me you won't burden the kids with funeral costs when I'm gone." Sarah's final words echoed in my mind.

I didn't realize how bad our financial situation was until that moment.

At 73, having just lost my wife of 48 years, I was staring at a bill that would wipe out everything we had saved.

Just imagining calling our daughter Jennifer to ask for money made me sick inside.

Walking to my car after that appointment, I sat there and sobbed.

After working 47 years at the plant and saving every penny we could, I knew our nest egg wasn't huge...

But not like this...

I was constantly worried, avoiding family calls because I felt like such a failure.

I dreaded the thought of burdening my kids with debt instead of leaving them something.

Simple conversations about money left me panicked and my chest tight.

I lived in fear because our "nest egg" was a joke. I made excuses to avoid talking about the future with my children.

I was becoming the father who leaves problems behind, and it terrified me. Every bill reminded me of my broken promise to Sarah.

That night after the funeral home visit, I called both my kids, voice breaking: "I can't afford Mom's funeral. I need help."

"Dad," they both said, voices breaking, "don't worry about money right now." I hung up and felt like the biggest failure.

I was terrified of becoming another burden on my family.

I didn't recognize the man in the mirror anymore. I was following the same path as so many seniors who leave debt instead of legacy.

It's a shame that...it takes something SERIOUS as this, for me to finally get serious about protecting my family's future.

First, I made "small" changes — cut expenses, looked at CDs, and tried traditional savings approaches.

But inflation took over, and I found myself losing purchasing power daily. I kept telling myself "Harold, you'll figure this out".

Some things were just out of my hands, and honestly, what other choice did I have?

Then weeks later, the funeral director called out of the blue. He told me something that changed everything...

"Harold, there is something simple I call 'The Legacy Shield'. If you set it up right you could leave a legacy for your kids so they won't have to go through that again."

When he told me about families who never worry about funeral costs, I was skeptical at first. I just couldn't believe it when he told me about people who actually become WELL-OFF when someone passes away, using that same "strategy".

But just to be sure, I called my old friend Richard who works with wealthy families. He gave me the green light, so I jumped right in!

I started doing exactly what Richard told me. Nothing extreme, just one simple setup.

I was shocked to learn how simple it was. I was amazed...

I burst into tears: "Oh my God... my family will never have to worry again!"

I immediately called Richard: "You're not going to believe how relieved I feel!"

And now, 6 months later... MY KIDS WILL RECEIVE A LEGACY WHEN I PASS AWAY - AND SARAH'S FUNERAL WAS JUST THE BEGINNING!

Soon my mindset started to change.

I've been sleeping so well lately, and noticing that my confidence is coming back too!

Knowing this legacy is guaranteed still feels so unreal, especially being able to promise my kids real money when I'm gone!

Plus, I didn't even mention that as this "Legacy Shield" grows, I can access increasing amounts for emergencies!

The best part is my kids get the legacy tax-free!

Even better, my kids were shocked when I showed them the guaranteed legacy I would leave behind.

Jennifer hugged me and cried "Dad I'm so proud of you thinking ahead for us"

As tears fell down my face "If only me and mom found out about this earlier"

Now, I tell every senior I come across, this "Legacy Shield" was a total game-changer for me!

I'm so grateful the funeral director and Richard shared this secret with me.

But, as we know, financial advisors can get in trouble for sharing this "stuff" because they can't make commissions on it. If you can't find this later, you'll know why. Don't wait if leaving debt behind is a concern.

Click Below to discover The Legacy Shield that saved my family from another financial ruin.